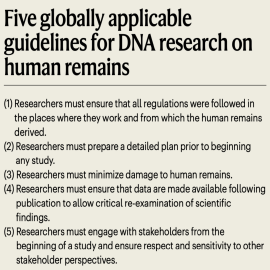

Read David Reich’s high impact Nature article (translated into 23 languages) prescribing ethical guidelines for the handling of human remains in research.

Insights from our multidisciplinary collaboration have generated dozens of publications in our first four years, with more underway.

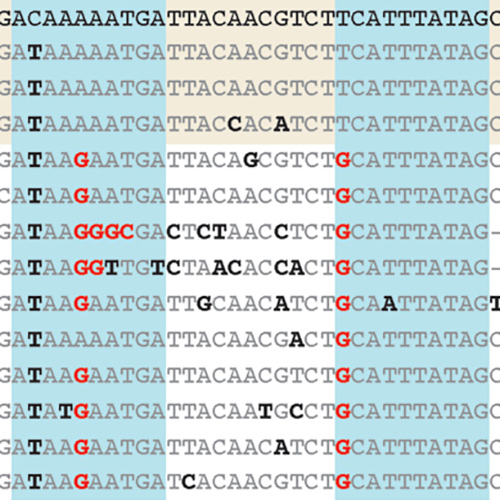

We as a species have long sought to understand how our capacities for art, science, and culture emerged. When during human evolution did our modern brains evolve? What are the genes implicated in this evolution, and how do they compare to other primates? How does our experience and environment change the behavior of these genes, and what impact does that have on how our brains develop?

The mission of the Paul G. Allen Discovery Center for Human Brain Evolution at Boston Children’s Hospital and Harvard Medical School is to understand these questions using an innovative and multi-disciplinary approach.

This research is supported by the Allen Discovery Center program, a Paul G. Allen Frontiers Group advised program of the Paul G. Allen Family Foundation.

The ADC at Boston Children’s Hospital and Harvard Medical School, established in 2017, was renewed for a second phase of four-year funding in 2022.

Learn more about our center, investigators and our sponsors here.